Bitcoin, the world’s first decentralized digital currency, has come a long way since its inception in 2009. From being a niche asset traded among a small group of tech enthusiasts to becoming a global phenomenon with a market capitalization in the trillions of dollars, Bitcoin’s journey has been nothing short of remarkable. A key driver of Bitcoin’s meteoric rise has been the evolution of trading and the emergence of cryptocurrency exchanges.

The Birth of Bitcoin and Early Trading Methods

Bitcoin was created by an anonymous individual or group of individuals under the pseudonym Satoshi Nakamoto in 2009. In its early days, Bitcoin trading was primarily limited to peer-to-peer (P2P) transactions, where individuals would trade Bitcoin directly with one another. Early transactions often occurred on forums like Bitcointalk, where users agreed on a price and conducted trades manually.

Another popular method of acquiring Bitcoin in the early days was through mining. Miners would use their computer hardware to solve complex mathematical problems and validate Bitcoin transactions. In return, they would receive newly minted Bitcoin as a reward. This process allowed miners to accumulate Bitcoin without having to trade or purchase it directly.

The Emergence of Bitcoin Exchanges

As Bitcoin’s popularity grew, the need for a more streamlined and efficient way to trade the digital asset became apparent. This led to the creation of Bitcoin exchanges, which provided a platform for users to buy and sell Bitcoin using various fiat currencies or other cryptocurrencies.

The Role of Exchanges in the Expansion of Bitcoin Trading

The emergence of cryptocurrency exchanges played a crucial role in Bitcoin’s expansion, making it more accessible to a wider audience. Exchanges provided a user-friendly interface and simplified the trading process, removing the need for manual P2P transactions.

Furthermore, exchanges allowed for the integration of advanced trading features, such as margin trading, futures, options, and algorithmic trading. This attracted a more diverse range of participants, including retail investors, institutional investors, and professional traders.

Exchanges also listed new cryptocurrencies and digital assets, enabling users to trade a wide variety of assets beyond Bitcoin.. This helped to further grow the cryptocurrency market and increased overall trading volume.

Technological Innovations in Bitcoin Trading

As the cryptocurrency market matured, so too did the technology underpinning Bitcoin trading. Exchanges began to implement more advanced order types and trading features, allowing users to execute more sophisticated trading strategies.

One such innovation was the introduction of Application Programming Interfaces (APIs), which allowed developers to build custom trading tools and applications that could interact directly with the exchange’s trading platform. This led to the rise of algorithmic and high-frequency trading, where traders use automated programs to execute trades based on pre-defined rules and market conditions.

Decentralized exchanges (DEXs) also emerged as an alternative to traditional centralized exchanges. DEXs operate on blockchain technology, allowing users to trade cryptocurrencies directly with one another without the need for an intermediary. This decentralized approach offers increased security and privacy while also reducing the risk of a single point of failure.

Another significant innovation in Bitcoin trading was the introduction of derivative products, such as futures and options. These financial instruments allowed traders to speculate on Bitcoin’s future price without owning the underlying asset directly. This led to increased liquidity and trading volume in the market, as well as the involvement of institutional investors, further legitimizing the cryptocurrency space.

Regulatory Challenges and the Future of Bitcoin Trading

While the evolution of Bitcoin trading and the emergence of exchanges have played a critical role in the expansion of the cryptocurrency market, they have also attracted the attention of regulatory authorities. As the market has grown, so too have concerns surrounding consumer protection, market manipulation, and the use of cryptocurrencies for illicit activities.

Many countries have begun to introduce regulatory frameworks to govern cryptocurrency exchanges, often requiring them to register and comply with anti-money laundering (AML) and know-your-customer (KYC) regulations. While these regulations have the potential to create a more secure and transparent market, they may also impose barriers to entry and stifle innovation in the cryptocurrency space.

Looking ahead, Bitcoin’s evolution will likely continue with technological advancements and new trading products. Decentralized finance (DeFi)

platforms, offering a range of blockchain financial services, may significantly impact the future of Bitcoin trading. Additionally, the continued involvement of institutional investors could lead to further market growth and increased legitimacy for cryptocurrencies.

Ultimately, the future of Bitcoin trading will be shaped by a delicate balance between innovation, accessibility, and regulatory compliance. As the market matures, it will be fascinating to see how various forces shape Bitcoin’s next phase.

Bitcoin.me and Trading Bitcoin on the Exchange

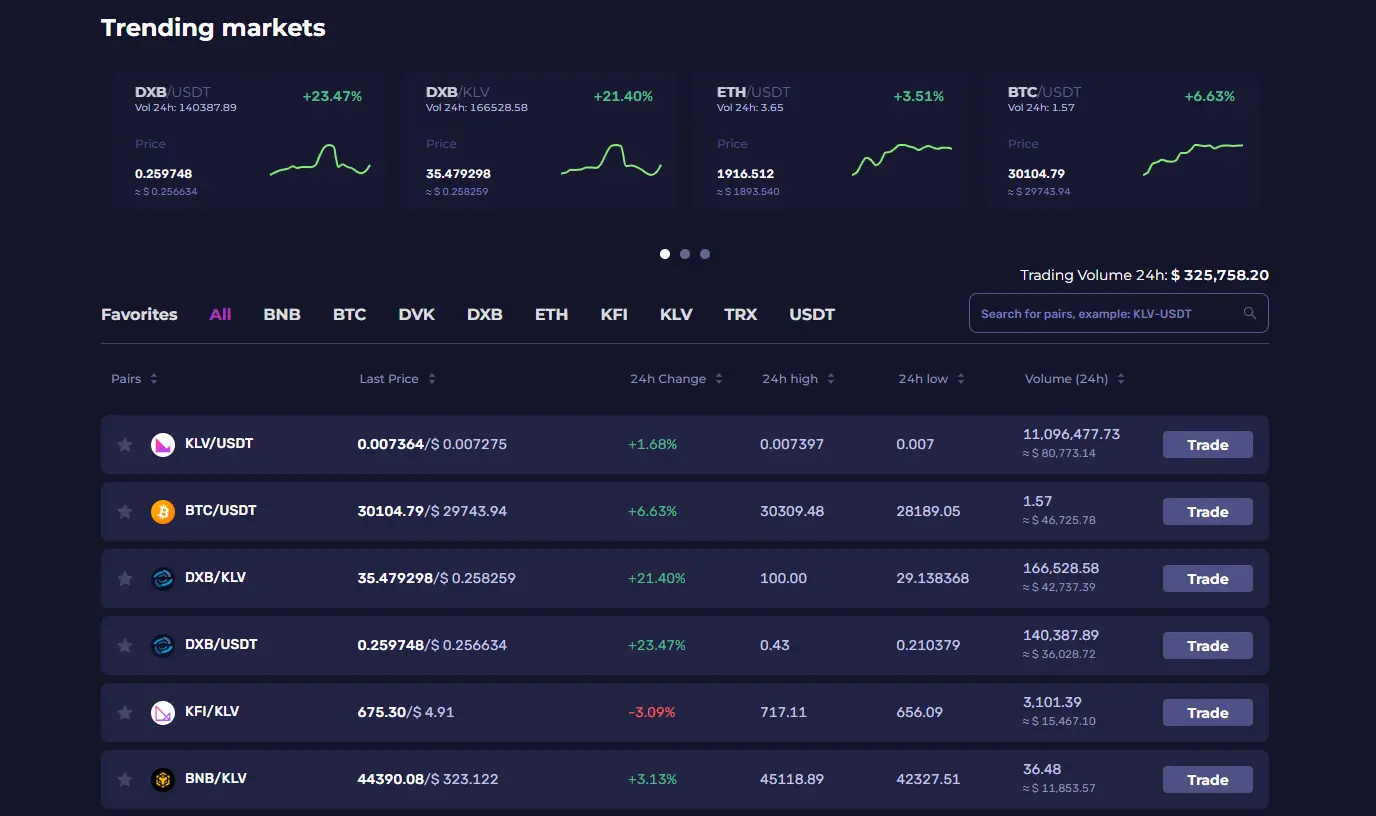

Bitcoin.me (previously referred to as Klever Exchange) is a relatively new player in the cryptocurrency exchange space, offering a user-friendly and secure platform for trading Bitcoin and other cryptocurrencies. Focusing on simplicity, security, and accessibility, Bitcoin.me aims to provide a seamless trading experience for both beginners and experienced traders.

Key Features of Bitcoin.me

Bitcoin.me boasts a range of features designed to provide a smooth and secure trading experience for its users:

-

User-Friendly Interface: Bitcoin.me offers an intuitive and easy-to-navigate interface, making it simple for users to trade Bitcoin and other cryptocurrencies.

-

Security: Bitcoin.me prioritizes security, implementing various measures to protect user funds and data. These include two-factor authentication (2FA), secure storage of user funds in cold wallets, and ongoing security audits.

-

Cross-Platform Compatibility: Bitcoin.me is available on both web and mobile platforms, allowing users to trade Bitcoin and other cryptocurrencies from any device with an internet connection.

-

Multiple Trading Pairs: Bitcoin.me supports a wide range of cryptocurrencies, allowing users to trade across various pairs..

-

Low Fees: Bitcoin.me offers competitive trading fees, attracting users looking to minimize costs when trading Bitcoin and other cryptocurrencies.

-

Customer Support: The Exchange provides 24/7 customer support to assist users with any issues or questions they may have.

Trading Bitcoin on Bitcoin.me

Trading Bitcoin on Bitcoin.me is a straightforward process, even for those who are new to the world of cryptocurrency trading.

Step-by-step guide on how to trade Bitcoin on the platform

-

Create an account: To trade on Bitcoin.me, users must provide their email address and set a password. Users may need to complete a KYC process, depending on their location and the platform’s regulatory requirements.

-

Deposit Funds: Once the account has been created and verified, users can deposit funds into their Bitcoin.me account. Users can deposit either Bitcoin or other supported cryptocurrencies, or they can hop over to Klever Wallet K5, buy crypto using fiat currency and send that crypto to the exchange.

-

Select a Trading Pair: After depositing funds, users can navigate to the trading page and select the desired trading pair (e.g., BTC/USDT or KLV/BTC).

-

Place an order: Users can place market, limit, or stop-limit orders to trade Bitcoin on Bitcoin.me. A market order is executed immediately at the best available price, while a limit order allows users to specify a desired price at which the order should be executed.

-

Monitor and manage orders: Users can track open order status and view trade history on the platform. If necessary, users can also cancel or modify their open orders.

-

Withdraw funds: After trading, users can transfer their Bitcoin or other cryptocurrencies to an external wallet for storage or use.

Bitcoin.me is an example of a modern cryptocurrency exchange that prioritizes user experience and security while offering a quality range of trading options for Bitcoin and other digital assets.

As the cryptocurrency market continues to evolve, exchanges like Bitcoin.me are poised to play a critical role in facilitating the growth and adoption of Bitcoin trading.